Digital Energy Mining is an energy technology and digital infrastructure development company founded in Budapest in 2019 by energy experts.

We are an international company with headquarters

in United States and offices in several countries

around the world. The mine scale ranks top 5 in the

industry.

Renewable energy optimization and network balancing service technologies are in operation in many countries around the world.

The biggest cost of cryptocurrency mining is the electricity bill. Mining is done using the energy generated during the extraction of hydrocarbons that has hitherto not been used. Green cryptocurrency mining is truly realized.

As a first step in the partnership, a 1 MW site will be developed as the first phase of a 20 MW development. Afterwards, the capacity of the completed data center will increase to 100 megawatts.

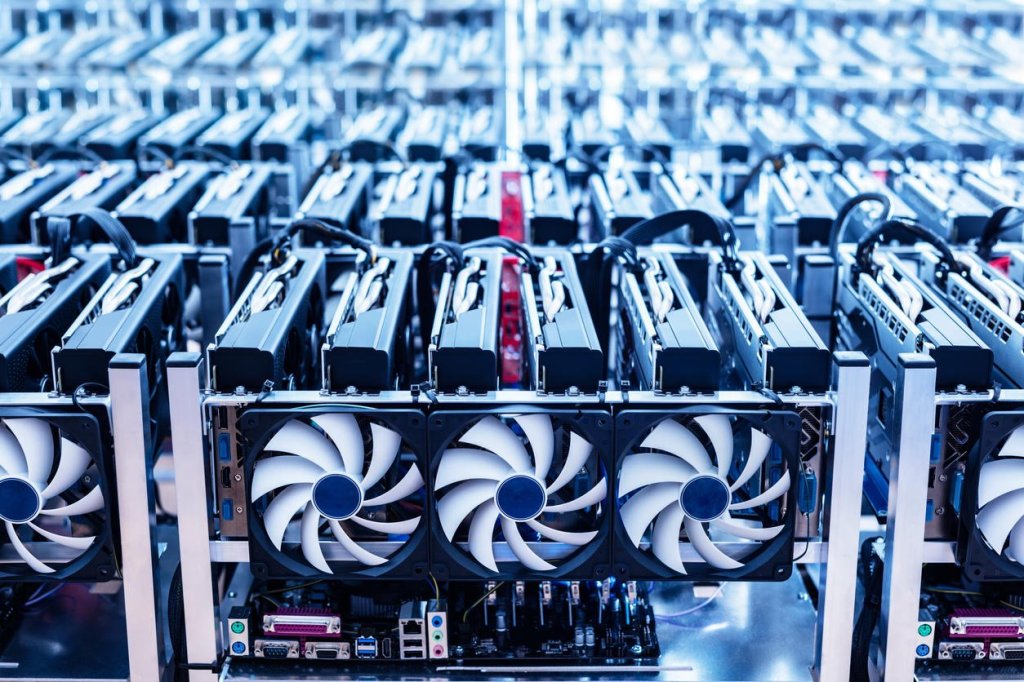

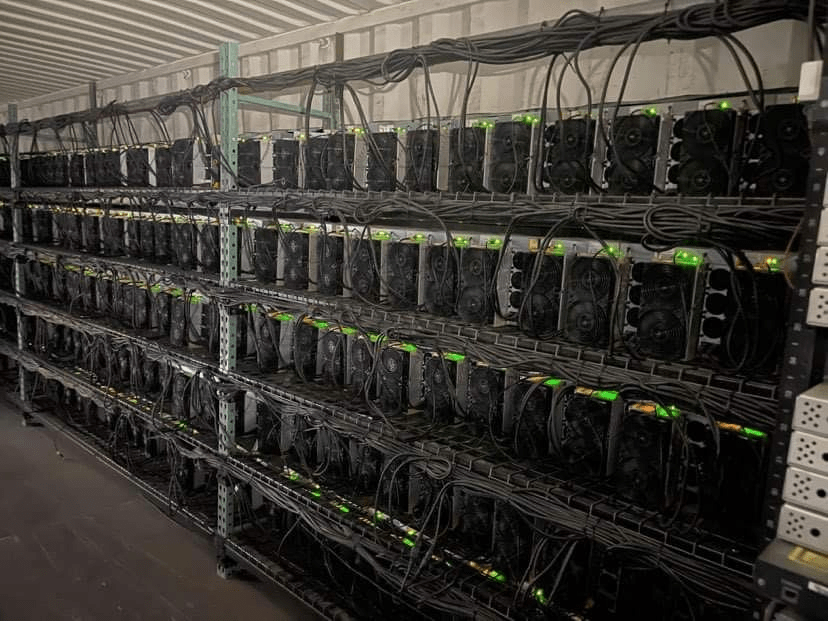

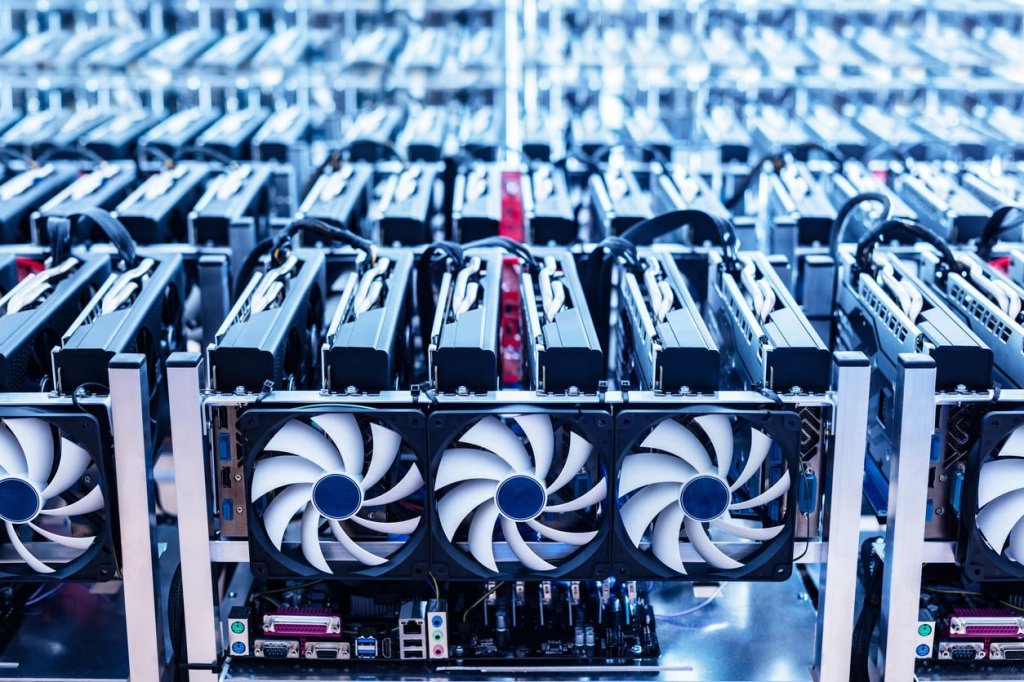

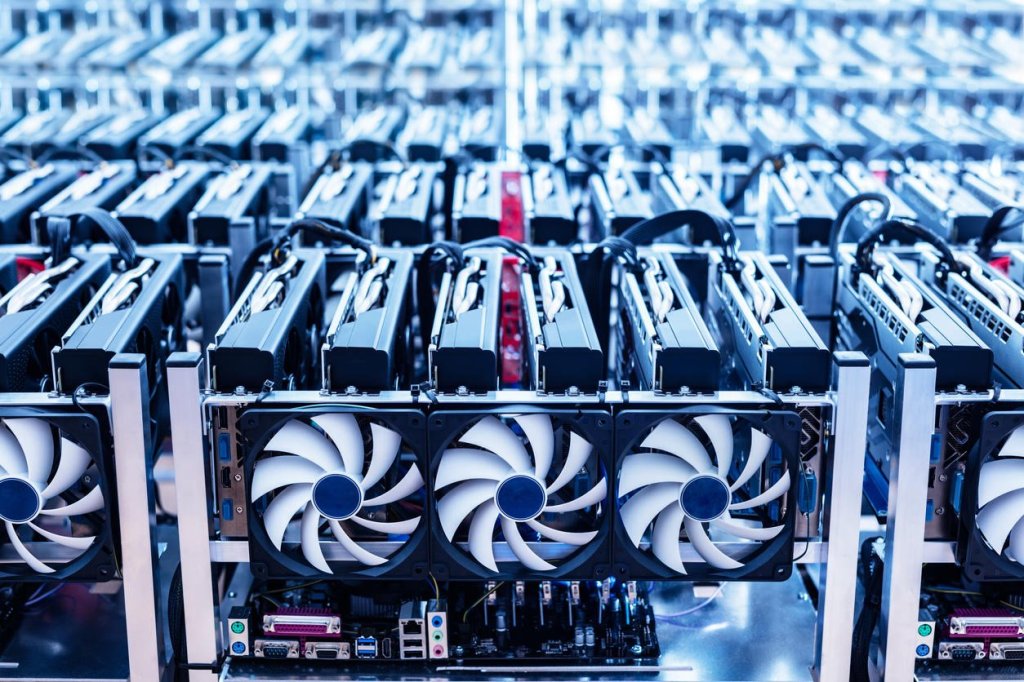

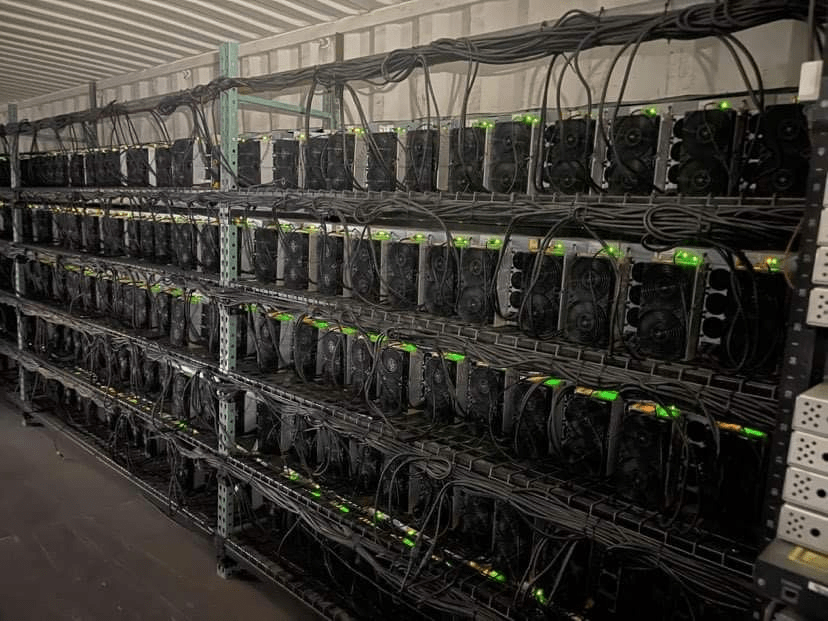

We specialize in mining cryptocurrencies. And it is efficient and large-scale.

We have been building, managing and scaling highly profitable industrial scale Bitcoin mining facilities for the past time.

Since our company was established, more than 20.000.000 users have used our world-leading cloud computing service.

Daily mining usually starts at UTC 00:00 and ends at UTC 23:59:59. Therefore, the time between two outputs can (and will) be more than 24 hours at times, and less than 24 hours at the same time. In any case, you will definitely receive daily mining output.

An open source monetary system can bring benefits to the world, bring benefits to people, and bring better technology to companies.

Since our establishment, we have grown rapidly and experienced many things. But one thing remains constant: we all believe in the future of digital currencies and love being part of this growing community.

For newcomers, home miners interested in mining,

and even large investors. Our mission is to make

earning easy and fast for everyone.

Data centers can provide enough flexibility to allow

power plants to take advantage of favorable market

events, such as high market prices. A stable base

load keeps power plants running at all times, making

it easier to take advantage of market opportunities

in stock exchanges and public procurement

tenders. Since the data center’s consumption can

be shut down completely, configured in 3000 W

increments, and scheduled in advance with hourly

or minute-by-minute precision, it can completely

consume the excess capacity of the power plant.

Digital Energy Mining data centers offer competitive rates for baseload consumption throughout the year and offer power plants the opportunity to take advantage of favorable stock trading prices. Participation in public procurement is also made easier as data centers act as continuous baseload consumers.

Digital Energy Mining’s solutions for different types

of generators

The Digital Energy Mining DATABOX has been designed to allow installation on any power source, including renewables, meaning any type of power plant can enjoy the benefits of data center production optimization. The data center requires only 25 square meters of spare secure space. We

recommend placing the container as close as possible to the power source, as installing just one short cable can have serious financial implications. There are no other technical or physical requirements for installation. If the power plant cannot provide an internet connection, we ensure a stable connection by installing a 4G antenna on the side of the container to receive signals from two different service providers simultaneously. Our server park has no specific cooling needs. The heat generated by the computers is free to dissipate through louvers on the sides of the containers. DATABOX comes with a power cord and requires a standard 400V three-phase power supply.

District Heating Plant

Characteristics of district heating plants Best suited for operating data centers. The entire business modeling phase was centered around the operation of these plants. In the summer, they only have to meet the hot water demand, so they have a lot of excess capacity. We have developed a solution that enables production even in the summer months and is based on electricity from combined heat and power from June to September. The heat generated in summer can be used to cool down the server park with the help of absorption coolers, so we can also use and generate income from the waste heat and electricity generated in summer. When selling electricity to Digital Energy Mining, there is no need to build internal capabilities focused on selling electricity. District heating plants can generate a steady stream of income from electricity produced at a fixed price without having to manage sales on a daily basis.

Natural Gas Plant Offers hedging option: Gas-fired power plants

generate electricity based on the difference. between the electricity price and the purchase price of natural gas (clean spark spread). When the electricity price is lower than the purchase price of natural gas, we provide a fixed price, and the natural gas can be hedged against our purchase price. As a result, the power plant’s production can be utilized

for a longer period and to a greater extent. Hydroelectric Power Station

For hydropower plants whose preferential electricity prices guaranteed by national power purchase licenses are about to expire, we offer an excellent option for further operations by taking over production contracts immediately. In case of high water flow, in addition to participating in regulator tenders, we can also use excess capacity, for which we offer competitive prices.

Solar Power Plant

In the case of additional investment, the data center can accelerate the payback of the solar plant, and the connection to the solar plant has a positive impact on the payback of the data center. Should state power purchase permits expire, Digital Energy Mining DATABOX can provide a new revenue stream to ensure future profitability.

We also offer an excellent alternative for consumers on investments that have not been activated, failed or received preferential tariffs from the state. Using Digital Energy Mining DATABOX, these investments can be activated and previously unused solar power plants can be brought into operation.

Biomass Factory

The on-site data center will allow the power plant to start up if additional fertilizer is available. When the remaining product cannot be sold in the traditional way, the surplus manure can be utilized, because the data center can consume electricity and provide

it with a competitive price.

Renewable Energy

Our mobile data centers can be installed to any renewable energy source. With the installation of our data centers, the erratic production of renewable power plants becomes balanced and predictable. Significantly accelerate return on investment by leveraging excess capacity. By deregulating the takeover regime, we offer a solution for resuming energy production with fixed- price takeover contracts.

Oil And Gas Well

Flare gas produced during the production of oil and gas wells is no longer burned in an extremely environmentally harmful manner, but can be utilized by installing gas separation devices. The separated gas can be used directly on site by installing a gas engine. The electricity generated in this way can be used directly in the gas engine.

All miners directly connected to the power plant can reap the benefits of economies of scale

Solve two problems with one solution Establishing a direct connection at the power plant site is at the heart of our business model for two reasons.

First, we contribute to optimizing power plant production, thereby assisting in load balancing at the scale of individual plants, and supporting grid balancing at the scale of the entire network.

Second, our partnerships with factories and on-site connections allow us to enjoy power supply at very competitive rates. Using a single solution to address the key challenges of both industries is a highly innovative concept that may be just the answer these industries are looking for. Electricity production, especially in countries where most of the electricity comes from renewable sources under ideal conditions, tends to be particularly volatile. With electricity storage still an unsolved problem, demand response tariffs force generators to optimize their production to the extreme.

Become an active participant in the equation Digital Energy Mining differentiates itself from

competing server operator companies by being an active participant in the balancing system. While most mining companies only act as electricity consumers, Digital Energy Mining participates in load balancing, which is critical for load-tracking plants to ensure profitability. Our key role in operations is to enable us to enjoy internationally competitive prices and long-term partnerships with power plants that rely on our consumption to optimize production.

Load Balancing Practice

The idea behind our load-balancing-based model is for power plants to monetize the positive difference between production costs and demand-response tariffs.

Design a business model with internal and external scalability We designed a business concept that provides

unlimited utility for both parties. However, according to our model, it requires considerable capital to take advantage of economies of scale. By creating a project company that accumulates investments and invests in data centers with excess capacity, Digital Energy Mining welcomes investors with any amount of capital at their disposal to benefit from the expertise we have gathered. As for overcapacity in power plants, we see no ceiling because grid balancing has become a critical issue as renewables gain more and more room in energy production.

Given that the parent company is responsible for the legal, professional and operational background of the power plant partners, we are able to reduce risk and ease the operational and administrative burden for investors. We simply put our operational know- how and excess capacity at the project company’s disposal with a modest shareholding ratio based on simple contractual agreements. Our investment plan is ideal for investors with any size of capital looking for passive income over a 4-year term.

Optimize investment structure Our recommended investment structures are

Special Purpose Vehicles (SPVs) or Joint Ventures (JVs), where the subsidiary does not bear any of the financial risks of the parent company, but benefits from smooth operations. Digital Energy Mining offers some of the lowest portfolio management fees on the market, covering all trading and exchange fees involved. In this structure, the parent company holds a small stake so it has an interest in the subsidiary’s long-term profitability.

Investors get 100% equity is also a viable model for the industry. However, it typically involves higher portfolio management fees and the portfolio manager’s direct interest in long-term profitable operations. Digital Energy Mining has made offers for both investment schemes and welcomes investors with a preference for either, but SPVs are strongly encouraged.

Estimated returns under extreme market scenarios

We analyzed the returns of various market scenarios to test whether our business model can ensure profitability in a bear market. Since the market price of Bitcoin is volatile and can change rapidly, not to mention the rapidly changing nature of this industry, we cannot guarantee returns, but can test our models in extreme market conditions. We found that, based on current exchange rates, returns should fall between 12-24 months, with 23 months being an extremely pessimistic scenario and 12 months being a very optimistic estimate. We deliver superior returns regardless of market conditions, thanks to our mutually beneficial relationships with power plants.

Competitiveness arises when server efficiency and affordable electricity meet

To be a true mover and shaker in the data center operations industry, market players must optimize for two key factors of competitiveness: server efficiency and affordable electricity rates. Without one, neither can achieve a favorable market position. Let’s take an example of an operator who has access to one of the lowest electricity prices in the world at $0.03/kWh but operates servers with an efficiency of over 100 W/Th. Because of his inefficiency, his servers have higher power demands, so he doesn’t benefit much from the low power rates. Since the market price of the most efficient servers (30-40 W/Th) is thousands of dollars, they are a natural barrier to entry. Access to outstanding server efficiencies and very competitive electricity rates is the privilege of a very small number of people only the elite of server operators. As you can see, there are fewer and fewer market participants in the lower left corner of the graph.

If you find electricity prices are high, you can beat the market by placing extremely efficient servers at the source. Ultimately, this is also the goal of Digital Energy Mining, to take advantage of the favorable prices guaranteed through direct connections to factories equipped with efficient servers.

Comparing the return on assets of different types of

investments

With the economy facing unprecedented challenges, investors quickly found themselves in a market with low returns and high risks. When we consider inflation, low-risk investors may choose government bonds whose returns converge to zero. Higher-risk investors may favor private equity and start-ups, which offer much higher returns. According to our calculations, even under the most pessimistic market scenarios, investing with Digital Energy Mining can provide returns that exceed those of high-risk private equity investments. We stress tested our business model under various extreme market scenarios. Since technological innovations themselves can have a significant impact on the market, and the market price of Bitcoin can be volatile, there is no upper bound on the return on an Digital Energy Mining investment, while the lower bound still exceeds the return on any other type of investment.

Global Mining Overview

Electricity prices are not the only factor in determining whether a country is ideal for mining investment. When we researched electricity prices and possible locations around the world, we found that not every country with reasonable electricity costs would be the best place to mine. What’s more, it’s true that very few situations are ideal.

Take Venezuela, for example, where electricity is reasonably priced but mining is considered an illegal activity. Ethiopia, on the other hand, has a very unstable legal system, which makes large-scale mining a major challenge. Following this logic, we examine the relationship between the ease of doing business and the price of electricity, and are left with a rather interesting distribution across countries. For example, when you look at Hungary, where a significant subsidiary of Digital Energy Mining is located, you see that both factors align with the mining industry. The EU is a stable legal system with well-developed financial markets.

Digital Energy Mining provides two-way scaling Since we monitor the global landscape to find such ideal locations to do business there, we can retarget investors from anywhere on this map. For server owners, we provide the technical requirements and management background to ensure a stable long- term revenue stream.

For power plants and energy industry experts familiar with grid balancing challenges, we offer several partnership models. We are ready to put in place the necessary management framework, marketing materials, including branding and communications, under the joint venture agreement, and we hold only a minority stake in order for our business model to scale globally.

Our Near Future Goals

Our mission is to map and maximize the value of excess capacity of global energy producers. The use of data centers to optimize power plant production is still considered an innovative solution, although there are many international precedents demonstrating the benefits of investing in data centers. Digital Energy Mining aims to be the cornerstone of the entire industry, providing affordable and viable solutions to power plant and server owners.

Digital Energy Mining will also provide server owners with the benefits of these synergies in the form of affordable electricity rates, system management and maintenance services. In addition to the additional flexibility, we are continuously improving our value proposition to power producers, so the DATABOX can serve as an alternative to energy storage units..

Our goals for 2021/22 include a network of data centers consuming over 100 megawatts, which will enable server owners to profitably enjoy industrial rates. In addition, we aim to plan for an additional 300 MW of excess capacity by the end of 2023. In addition, we also believe that the parallel development of stable corporate operations is essential. Through our activities, we hope to set an example in the industry and encourage investment in data centers by establishing a framework for operations, infrastructure and technical context.

Thanks for reading the whole blog

You must be logged in to post a comment.